Above the Fold

Financial Markets this Week

Hey wonderful people, here is a pulse of the financial markets this week

SpaceX IPO : Elon Musk confirms reports that SpaceX is planning to go public in mid 2026. It is valued at $ 800 billion currently

Unemployment Spikes in November : We got our November unemployment report on Tuesday. Unemployment rate increased to 4.6% in November, when compared to 4.4% in September. We talked about the Fed cutting interest rates by 25 basis points last week; the weakening employment data only substantiates the Fed’s decision

Intuition : lower interest rate → less borrowing cost for businesses → more expansion → more hiring → alleviates unemployment

Federal Workforce Count is Lowest in A Decade: With more staff taking on deferred resignations, the US government workforce (2.744 million) is at its lowest in over a decade

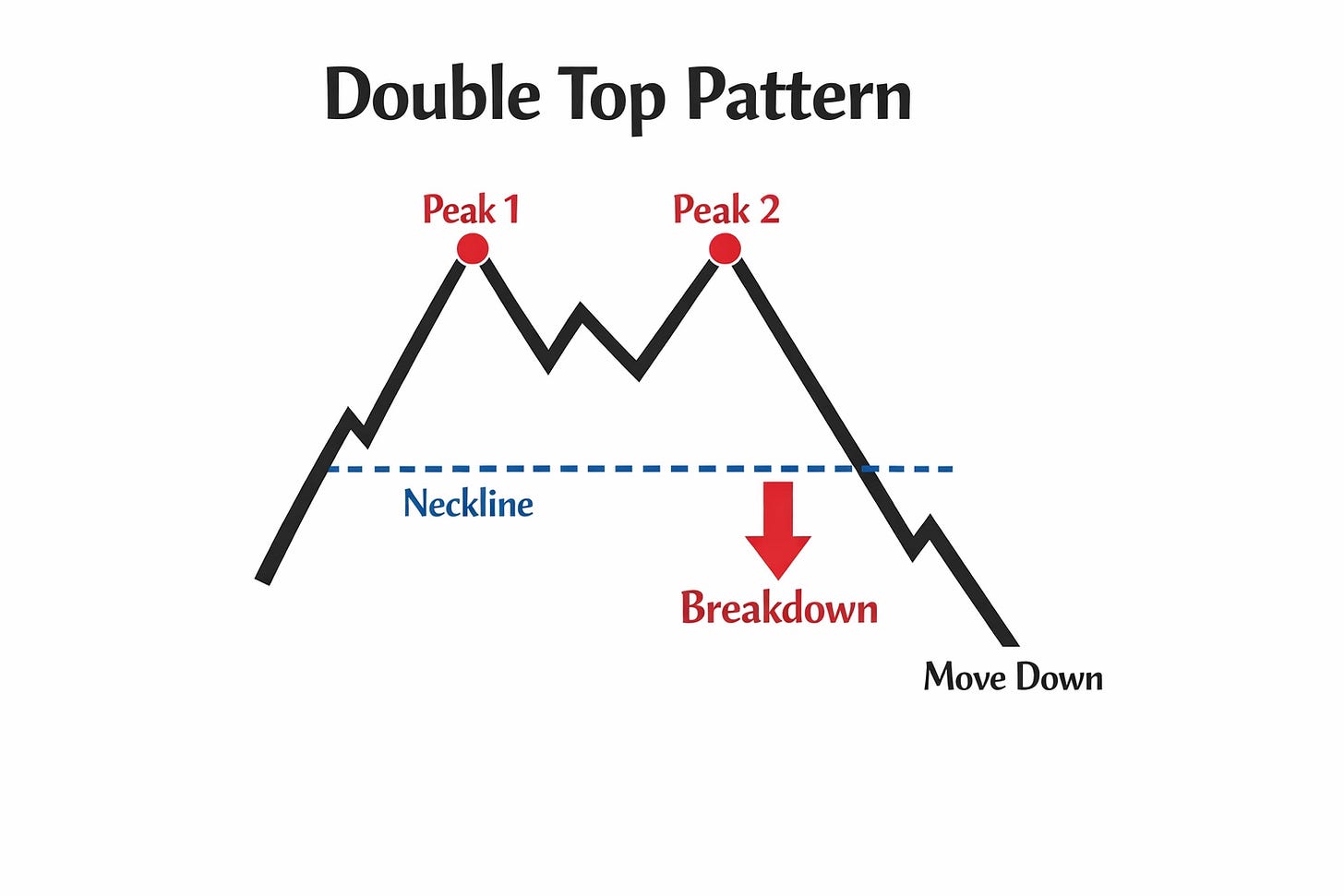

Double Top and Cash Holdings : S&P is in a Double Top pattern (high, drops down and high, pattern), which indicates that it is close to the top. For additional context, the Bank of America global fund manager survey reveals that cash holdings are at a very low 3.3% currently. The takeaway : fund managers are almost fully invested in the market as of December. The street hopes for a strong year end rally, we need to pay for those over-priced steaks and bourbon at Delmonico’s

Trump Group and Fusion Energy Technology : Trump Media and Technology Group (Ticker : DJT) merged with Alphabet backed fusion energy firm TAE Technologies, in a $ 6 billion deal. The plan is to construct power plants to satisfy AI’s demand for power, and DJT spiked significantly at open on Thursday

Inflation : We measure inflation using PCE and CPI. YoY CPI was 3% in September, and it was 2.7% in November - as this downtrends, it speaks to the Fed making the right decision to decrease rates last week. We did not have October data because of the shutdown. Intuition : Inflation decreases, so we do not need such restrictive higher interest rates and hence we decrease it, which we did. In reaction to inflation trending in the right direction, the market opened higher on Thursday

The World on Interest Rates : Similar to the Fed, Bank of England cut interest rates by 25 basis points (3.75% currently), whereas European Central Bank leaves rates unchanged. Overall, Europe feels inflation is stickier and hence interest rates remain unchanged. Bank of Japan which has historically low rates increased rates by 25 basis points to 0.75% (as expected)

NASDAQ Files to Extend Trading Hours : NASDAQ files with the SEC to extend trading hours, to 23h a day (0400 to 2000 EST, an hour of clearing break and then 2100 to 0400 EST). Right now, NASDAQ is open 16h a day, between 0400 and 2000 EST (including pre-market and after market hours)

NASDAQ wants to cater to global investors and traders as well, and the request for extended trading hours speaks to that. For context, BTC trades 24/7. On the flip side, the order book might be thin and there might be very less liquidity during the dead of the night (low liquidity essentially means → price jumps a lot due to less volume). Such low liquidity essentially defeats the purpose of extended trading hours. We have to see how it plays out. If the SEC approves this, this will be a significant structural change in the US equities market after a long time

CoreWeave : CoreWeave uses high interest debt to purchase chips from NVDA, then installs servers in data centers that it leases from landlords. Then, they rent that capacity out to AI firms. Because of rain and winds in the summer in Dallas, there was a 60 day delay in building out the capacity - and their share price tanked

This week, US DOE (US Department of Energy) announced a partnership with 24 organizations in an effort called the Genesis Mission, to harness the power of AI and thereby advance energy innovation in the US. I missed the news, but it was a catalyst that was a shot in the arm for CRWV’s share price. Once again - the market was looking for a reason to buy, and DOE gave it to them

I missed this play, it was an easy long play ... I hate missing obvious plays. I should pay more attention to the fuckin’ scanners. They told me, my most natural trading style is catalysts and breaking news. Because of my econ background, I need actual catalysts that drive price action to make the play, rather than trading just mindless technical support and resistance levels. I’m fine losing on a trade, but I fuckin’ hate not even making the play. I wasn’t even hungover and ... this cannot fuckin’ happen again.

I want to update you all on a couple of things before the end of the year, I’ll be in touch - have a fabulous weekend

Sources : WSJ, Financial Times, Barron’s, Briefing, US Department of Energy and Bloomberg