I love when two markets have meaningfully different prices, for what is essentially the same commodity - in this case, gold

Financial Arbitrage is where we take advantage of short-term difference in prices of an asset or a commodity - to realize profits

Its also a brilliant movie by the way - Richard Gere at his thieving and deceptive best … I love how under-stated he is, and yet, you can read everythin’ based on what he is not saying

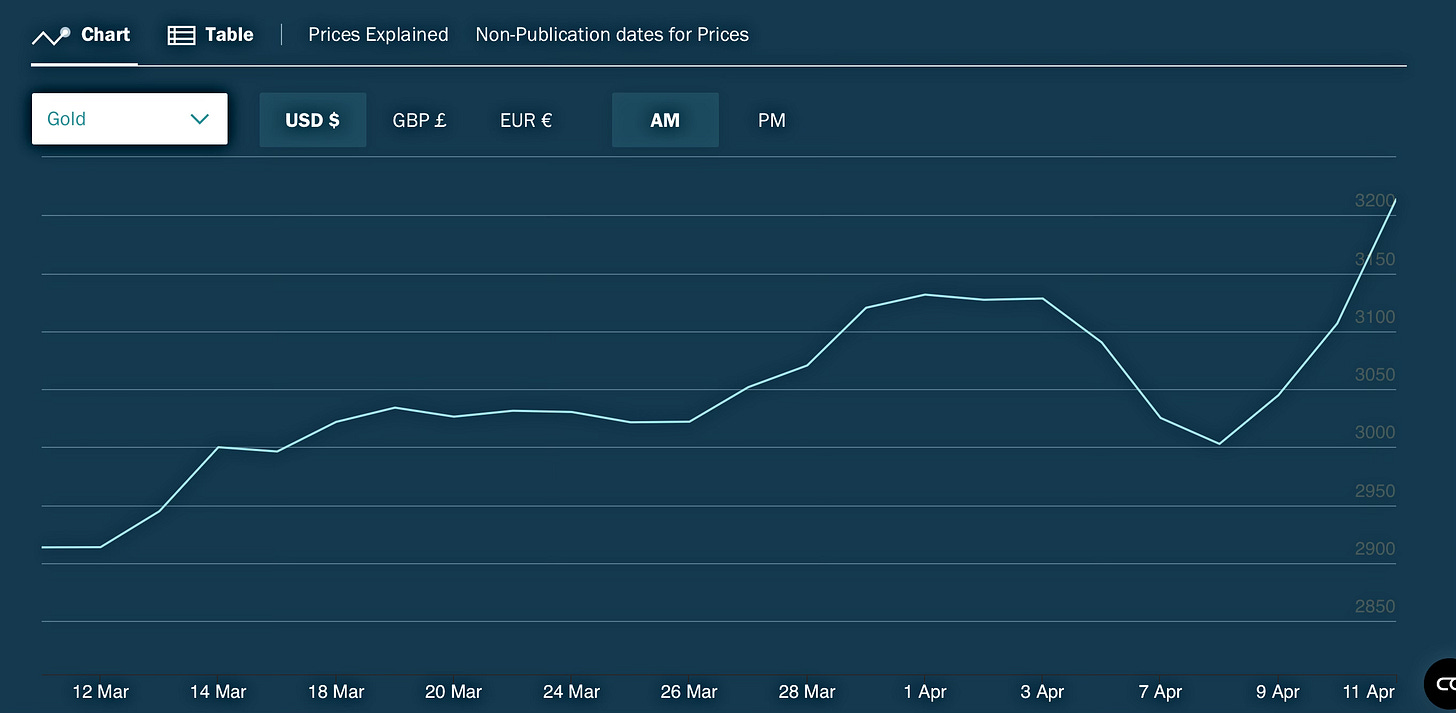

Because of the threat of tariffs - people and investors on our side of the Atlantic bought more gold. Investors generally consider gold to be a safe haven asset, and buy more of it when things are volatile. No surprises there

With risks due to tariffs, interest rates, inflation and the growth of our economy, they flocked towards gold - as they always do. As with anything, when you buy more of it, the price increases

This is from New York Commodity Exchange (COMEX) - for Gold

Because they did not have such trade policy threats across the Atlantic in London, there wasn’t any frenetic buying, and hence the price of gold stayed relatively calm (as in, lower when compared to New York)

This is the price of gold from London Bullion Market Association (LBMA). Sorry about the gray Y-axis label on a dark blue background - not my fault

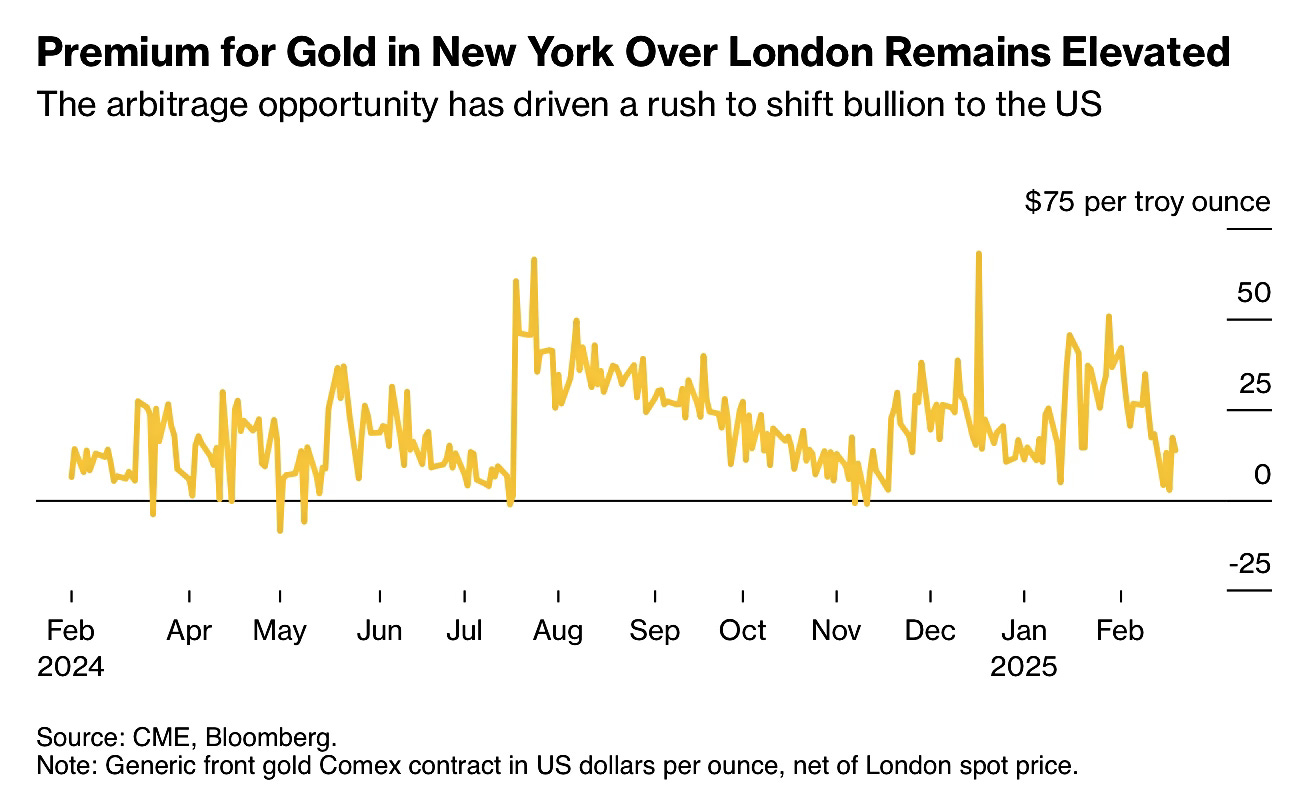

That’s the arbitrage opportunity - price is high in New York, and price is comparatively lower in London. Investors moved significant amounts of physical gold across the pond to take advantage of it

To fulfill contracts, you have to deliver 400 ounce bars in London, whereas on this side of the Atlantic, you have to deliver 100 ounce or 1 kg of gold. So, investors had to move gold bars to Switzerland to melt and recast it, before shipping it to New York

And even with that additional processing, the additional price premium they got from selling gold in New York was worth it. Premium in this case is the additional price of gold when you sell it in New York as opposed to London, if the price of an ounce is $ 3,000 in New York as opposed to $ 2,950 in London, the premium is $ 50

That’s about it

And investors took home tons of profits by taking advantage of such an arbitrage opportunity. Once DJT announced that gold is exempt from all tariffs - the premium went back to zero, as in, there is no meaningful difference in price between London and New York

And price for gold was more or less the same on both sides of the pond

I love simple things : cinnamon rolls, American cheese that don’t tear apart on a cheese burger, smoked Italian sausage on a slice of pepperoni, baklava with honey and pistachios, that smokey smell of chemical fumes and dust as the New York subway train - brakes at the station

… and financial arbitrage