Resources

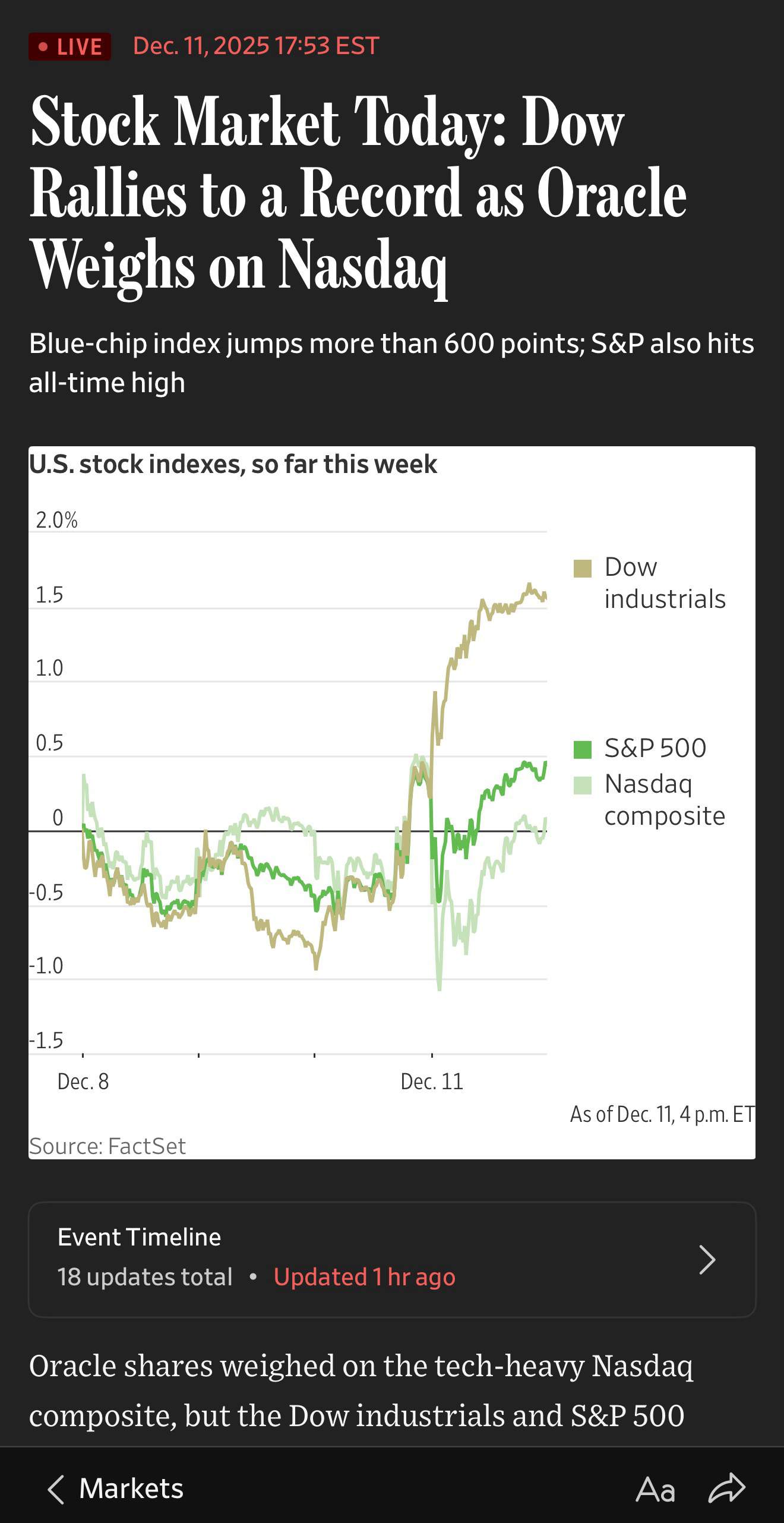

Economics is essentially the theoretical structure for finance. Macroeconomics can be the undeniable driver for certain market events, such as such interest rates influencing buy/sell patterns in the bond and small caps market this week (week of 12/8/25)

My background is in economics (I went to University of Michigan for my PhD), and I built quant and trading skills over the course of two years to get here. For three years before that - I used to devour the WSJ day in and day out, which essentially made me realize my own appetite and love for markets

You slowly close that gap between an event and markets reacting to, said event. Economics teaches you how to understand why the market reacted the way it did, to said event that happened yesterday. Quant Finance and Trading teaches you not to diagnose, but anticipate the same linkage between an event and the potential market reaction (stock price) to the event. That transition is slow and will not happen overnight, but eventually, you’ll make that transition between understanding … and anticipating

That in essence is the difference between economics and finance

And when you stand at that edge between understanding and anticipating, your brain rewires itself. That edge is doorway to infinite possibilities, just as likely - it is the doorway to your lethal and swift demise

A penthouse with a supermodel in Billionaire’s row, or broke and smokin’ street-meth underneath the Manhattan bridge ? It depends on if you can withstand and manage risk, and can control your emotions when the market is alive and volatile

Meditation changed my life

People who understand end up in the Ivory Tower of academia or prestigious national labs. People who anticipate end up on Wall Street. I came from academia and worked for one of the ten national labs in the country where I built risk (Monte Carlo) models, and eventually just found my way to Wall Street

As cliched as this sounds, I kept fearlessly feeding and nurturing what I knew I truly loved … supply demand curves

or, price action and volume at different timeframes

During the last year or so, I have had many people message me on Linkedin, and ask me for advice, and about the resources that I used during the transition. Some of you who asked me, read this space too. I wanted a space where I can consolidate all of these resources so that they are readily available to anyone who wants to use them

The highly specific tools of the trade - so to speak. You know - trade secrets

Trading and money is about psychology too, so you’ll see psychology resources here too. I also love reading about sports, and you’ll see resources that have helped me in how I think about things as well. Competitive sports has significant parallels to trading

I’ll keep updating these with time - hope this helps !

#LFG

Deepak

The Trading Bible - for foundation and the skeleton of trading

How to develop your own playbook

Inside the extremely secretive world of high-stakes finance in New York City (I love the way Carrie Sun writes)

How to think about edge, risk and decision-making (Agustin is an ex-Jane Street trader and he is a quant). Quants and discretionary traders do not always get along, and there is a lot of friction, but - if you are into quant, this is still an excellent read

Quant Blueprint : My training ground. I used to teach for a living, and hence I know great teachers when I see them. I came from an econ background, and hence, I had to understand the probabilistic frameworks and the way of thinking in this world. I absolutely loved it and if you put the time in, you will get a lot out of it. It is comprehensive, structured and insanely well explained. Here are a few videos

Table stakes - to trade on the Street

The River - the people who are comfortable with risk inevitably veer towards Las Vegas, Silicon Valley and Wall Street. Vegas is Wall Street without a stop loss !

The secret to being successful on Wall Street was knowing something nobody else knew - Asymmetric Information (edge is not from intelligence, edge is from knowing something first … before others). Do you think we read and devour news every morning because we want to be fuckin’ most informed ? Dude !!

Liar’s fuckin’ Poker

Sleep (My average is 8.5 h a night, with 3 to 4 h of deep sleep every day). I use ShutEye to track it. Sleep is how your brain resets itself and crystallizes what you learned that day. There is no way you can trade without good sleep. Strict, no alcohol rule between Sunday night and Friday evenings too

You do not rise to the level of your goals, you fall to the level of your systems - Amen (James Clear - Atomic Habits). James Clear, 3-2-1 Newsletter

Page One from Briefing.com (I’m extremely careful in what I read and I’m severely allergic to opinions). Before pre-market at 0830 EST, this is your three min read for where the US market is

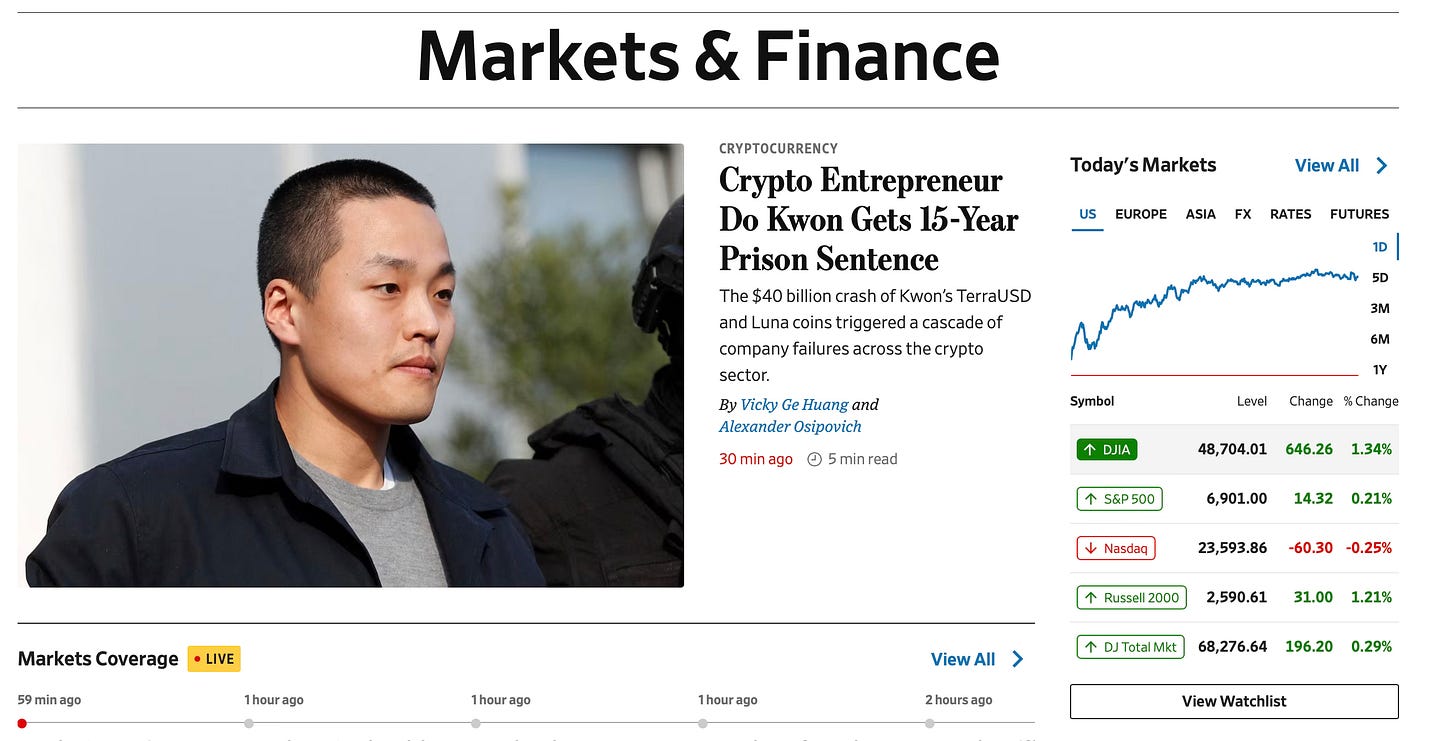

Do not be fooled by WSJ being owned by Rupert Murdoch. If it’s bad, I’ll tell you it is bad. WSJ does excellent reporting (Epstein files !), just don’t read their editorials

WSJ cannot afford to misinform us : when there is this much money involved, misinformation is not going to go down well with the Street. WSJ Markets and Finance is home base

Important to note : Breaking news updated multiple times a day and you can set notifications on your phone

SMB Capital Youtube Page - absolutely no crypto-bro nonsense and no swinging for home runs on every play. This is as serious as it gets and it is free (it is the next best thing to official training)

The industry is littered with your next door high school quarterback Joey-Bag-of-Donuts, pretending to be Tom fuckin’ Brady himself. Lance Breitstein isn’t one of them. His Youtube Channel and newsletter is one of the best on the Street. His X is awesome too

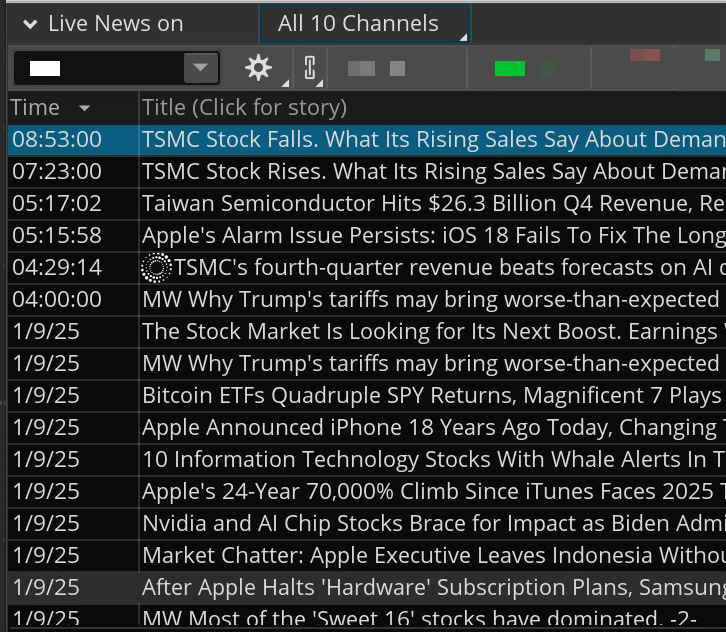

Thinkorswim Desktop Newsfeed - real time updates keep flowing in, with each trading minute

Mostly, about how to deal with high-stakes and high-stress situations - from someone who has been in the crucible and won (Seven times !!) - Tom Brady

PS : Did I tell you I went to Michigan ? Ann Arbor taught me everything, but most importantly, it taught me how to learn !

Graham Weaver, Co-Founder and Managing Partner of Alpine Investors. Great newsletter on how to think about and structure your career, and how to think about maximizing your potential in your career