Hope y’all are doing awesome ! Been a while since I have touched base, I took a little break so that I have newer and fresher thoughts to write about. I’m fine letting time take its natural course, before I feel like I’m ready to touch base again

I’m in love with markets, where the price moves up and down based on all of our buy and sell patterns

I’m not talking about a market for an exquisite cut of a New York strip at Whole Foods. I’m not referring to this, mostly because the price of that cut does not move within a day, based on how much we buy, we take that price as exogenous (as in, we take that price as a given)

More importantly, you and I merely buy a cut of prime New York strip from Whole Foods, as opposed to, say, buy and sell that at the same time, in said market place

I’m talking about a market for an asset that we can buy and sell in the same place, such as for a stock of NFLX or PLTR

I can make a market for anythin’, or rather, in the quants world, we can quite literally make a market for anything

At its core, a market needs two things,

What we think the fair value of an asset is, and then based off of that - the speculation of where the price would end up, day in and day out - based on how much of it is bought and sold in the market

Let’s have fun with this - let us make a market for Game Six of the Eastern Conference Finals tonight

My Knicks are down 2-3 and they go to Indy, to stave off elimination, and here are the odds

Knicks start the game as +150 underdogs, and we need to convert that to implied probability

P(x, Knicks win) = 100 / (100 + 150) = 100 / 250 = 4/10

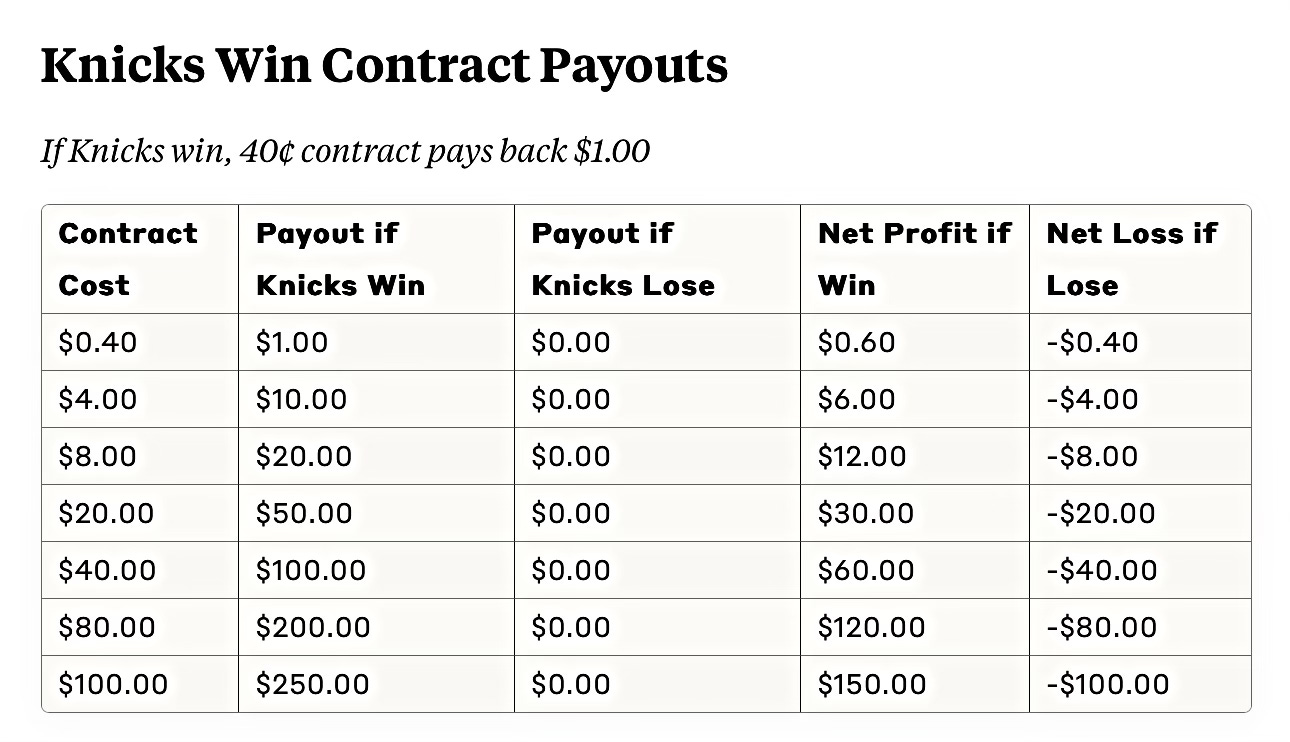

So, Knicks have a 40% chance of winning this game, that’s your fair price, or, the cost of your starting contract

If you want to make a market where your friends can trade on (with you, essentially being the market maker), there are two things that can happen

For people who go long, as in, for people who believe the Knicks will win tonight

They’d buy a contract from you at 40 cents each, for the Knicks winning, and if the Knicks do win, you owe every buyer who bought the contract $ 1, in total payout

In this case, if the Knicks win, you as the market maker lose 60 cents, for each contract sold, and each buyer gains 60 cents for each contract bought

For people who go short, as in, for people who believe the Knicks will lose tonight

They do the reverse. They sell you the said contract, at your starting price. Since, this trader believes the Knicks will lose tonight, they’ll short the Knicks. They’ll sell a contract at 40 cents to you, and you give each seller 40 cents

If the Knicks win, each seller owes you $ 1 (60 cents loss for them), and if the Knicks lose, well, they keep the 40 cents and walk away with a 40 cent profit

Strive to be Flat

As a market maker, you neither want to be too short or too long, you want to maintain as flat a position as possible, and hence, you’d strive for a 50/50 split in terms of traders who are short and long

How the Market can Move ?

Say, if you have a lot of buying pressure, then you’d want to increase the contract price from 40 cents to 50 cents, because now, the profit is only 50 cents if the Knicks win (as opposed to the previous 60 cents)

This reduces buying pressure, and incentivizes more short sellers to enter the market (because if the Knicks lose, now they get to keep 50 cents, as opposed to 40 cents a contract)

- making it more likely that you as a market maker stays flat

As a market maker, your objective is to get a risk-less profit (% from each contract bought or sold), as opposed to your profit depending on who wins the game

Thanks claude.ai for this table below

Making a market is so much more fun than fantasy football

You can make a market for anything

- NBA finals, NFL, Superbowl, Formula One, Indy 500, Roland Garros, Wimbledon, and Tay-Tay and Travis ending up at the altar in the future

I deeply appreciate you - for allowing me to share my love for quants with you

Go Knicks ! I'll see y'all back at the Garden for G7