Israel attacked Iran on Thursday, and Iran responded by attacking Tel Aviv on Friday evening - and the global markets reacted

Oil: Anytime when there is a conflict in the middle-east, investors far and wide around the world get nervous about supply shocks (oil shortages). So, they buy futures to risk-hedge potential price spikes in oil

Such buying pressure increases price of futures for Brent Crude and West Texas Intermediate

Brent is the global oil benchmark, and West Texas Intermediate is the United States oil benchmark

Oil Corporations : Sometimes, oil producing firms get a spike too, because investors expect more profits for those firms. The firm’s production cost remains relatively the same as it was before the conflict, but now, the firm can sell oil at a higher price than before. This increases profit margin. Hence, investors react by buying more of the stock

Below is Chevron and Exxon

Gold: When there is a risk of oil shortages in the middle-east, investors worry about energy driven inflation, and hence, they flock towards gold (the hedge against inflation). Here is gold futures from New York commodity exchange

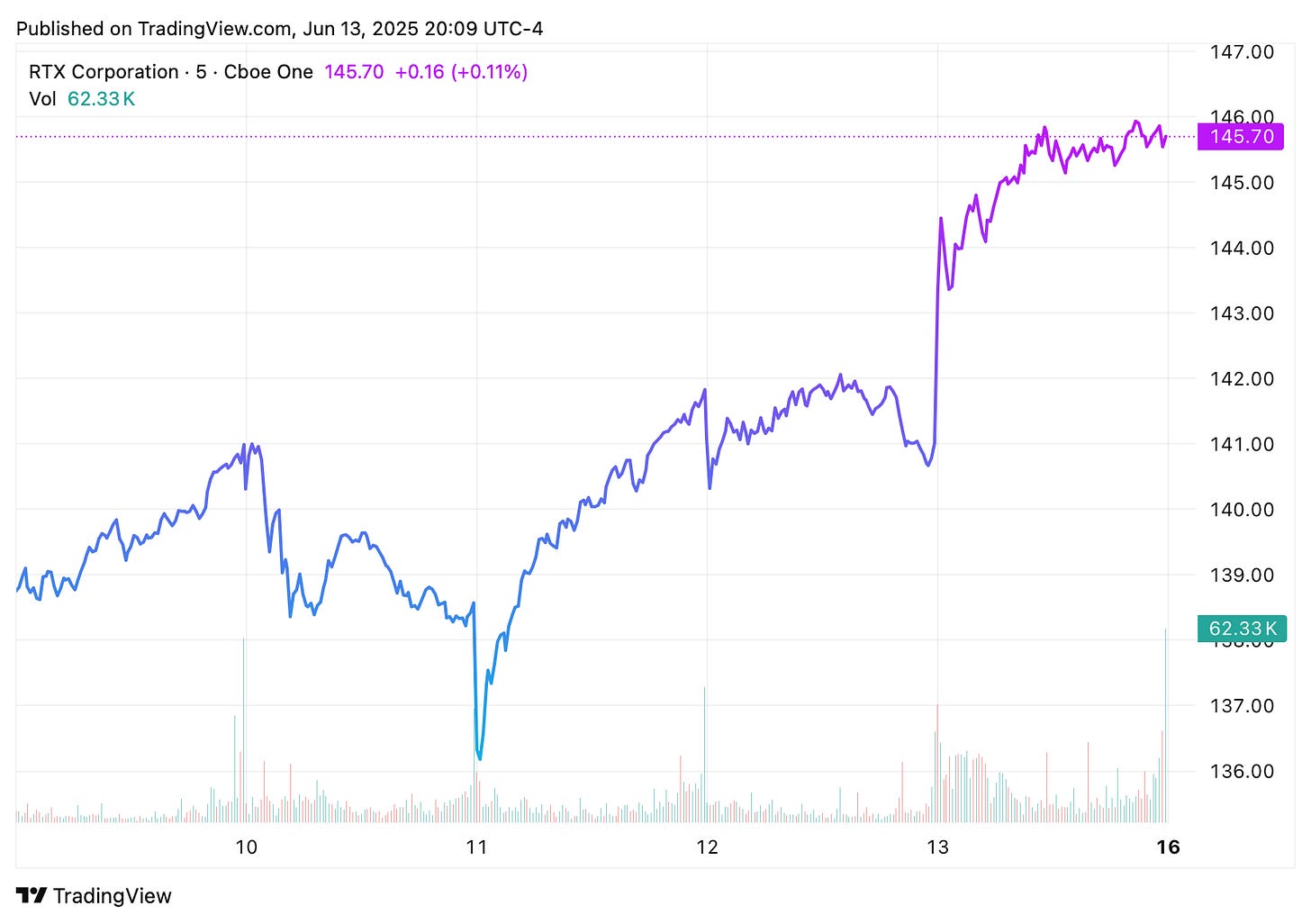

US Defense Contractors: Business for defense contractors spike during times of global conflicts. Hence, Lockheed, Northrop Grumman, Raytheon and L3Harris - have spikes in stock prices, in response to the conflict

Calling this a playbook is very generous, this is no more of a playbook than Coach Reid asking Patrick Mahomes to throw a touchdown when the Chiefs are down a score in the fourth quarter of a Super Bowl … and calling that his own playbook

But, investors do investor things … this is what we’d expect to happen when there is a war, and it is exactly what happened

Financial rationality at its very best !