United States Treasuries

When the United States runs a budget deficit (as in, when expenditures are higher than revenues) - the Federal Government issues treasuries to raise money. The treasuries can be in the form of bills, notes or bonds - they vary in terms of their maturity date and interest rates, but they are all different means to the same end

The bonds are typically sold using an auction. The results from the auction is what tells us, how much appetite (demand) there is for US treasuries. This is important information because, softening demand for US debt is something both the Federal Reserve chair and the White House would want to know of

Auctions

Imagine, I offer a bond for $ 100 with a yield (return) of 5%, and a maturity date of one year. So, if you invest $ 100 today by buying this bond, in one year, you’ll get $ 105. But I might get three investors bidding for this bond and hence the total value of bids I receive is $ 300

Bid to Cover Ratio

We typically call this Bid to Cover Ratio. It is the ratio of total bids received ($ 300) to the value of bonds I am auctioning ($ 100), 300/100 = 3. So, I received 3x in bids, when compared to the total amount I am auctioning currently. As this ratio drops closer to one, I’ll interpret that as softening demand for my offering

As a general rule of thumb, a good bid to cover ratio is 2 (as in, the bids are 2x when compared to what am offering currently)

The Debt Ceiling Debate

When congress plays roulette with the country’s credit rating (the Shakespearean tragedy that we call the debt ceiling debate), it has meaningful implications

Not raising the debt ceiling can potentially lead to the country not honoring its debt obligations (essentially, not paying back the investors who lent us money). All it takes for the market to get nervous is the uncertainty associated with the debt ceiling debate

To simplify the farce of the debt ceiling debate, it is like arguing whether to pay back your American Express credit card, AFTER, you have spent the money. If you don’t pay back your amex - it’ll sink your credit score, and the next time you want to borrow money, they’ll charge you a preposterous interest rate for it (because, lending to you is no more a safe bet)

It’s the same for the country too

If investors think the US will not pay them back, they will either demand more yield (this leads to the country paying more in interest, to keep borrowing), or the investors will simply bid less - and this will show up in the bid to cover ratio

The US carries a significant amount of debt and it is an actual problem, but the debt ceiling debate is not the way to solve it. Budgeting and tax code revisions are the way to solve it

This is also where DC meets New York. It is Wall Street that helps the government with the auctions and creates a secondary market (through brokerage firms such as Charles Schwab) - for us to resell treasuries if we need liquidity due to unexpected expenses

Auction Results

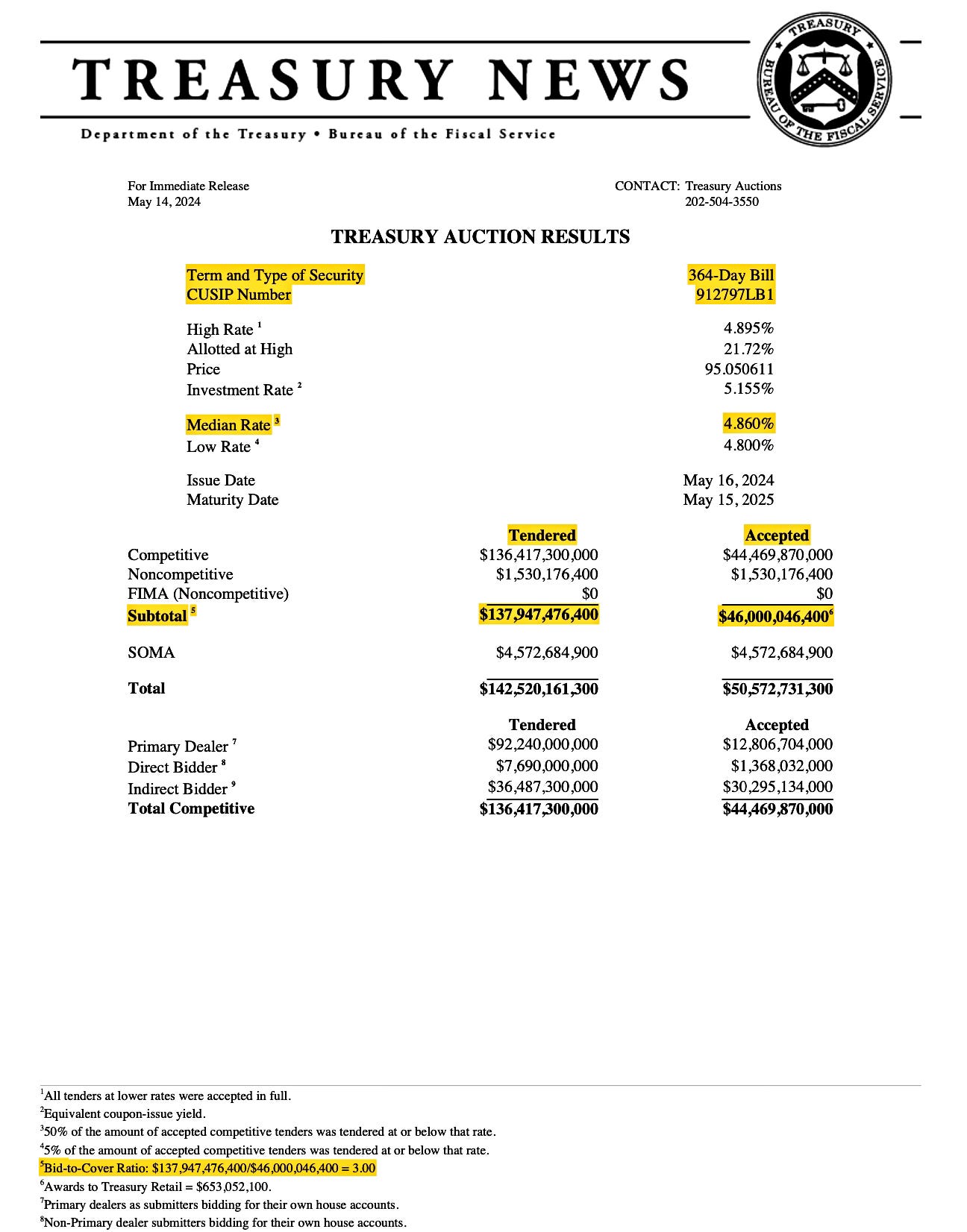

Here are the results from an auction that happened on the 14th of this month (source : Treasury Direct)

I have highlighted these in yellow : it is a one year bill with an interest rate of 4.86%. The CUSIP number is the one you can use to find this bill on your brokerage firm website (such as Charles Schwab or Fidelity), where you buy stocks and bonds

You’ll see tendered (total bids) ~ $ 137 billion, and accepted (auction amount) ~ $ 46 billion. So, the bid to cover ratio is (137 billion / 46 billion) ~ 3 (also highlighted at the very bottom as a footnote)

In essence, they got 3x in terms of demand, when compared to what they wanted to offer, for a one year note, for a moderate yield of 4.86%. When we say, the global appetite for US debt is bottomless - the bid to cover ratio is one way to prove it

When investors far and wide around the world buy US treasuries, this is what we mean by, other countries own our debt

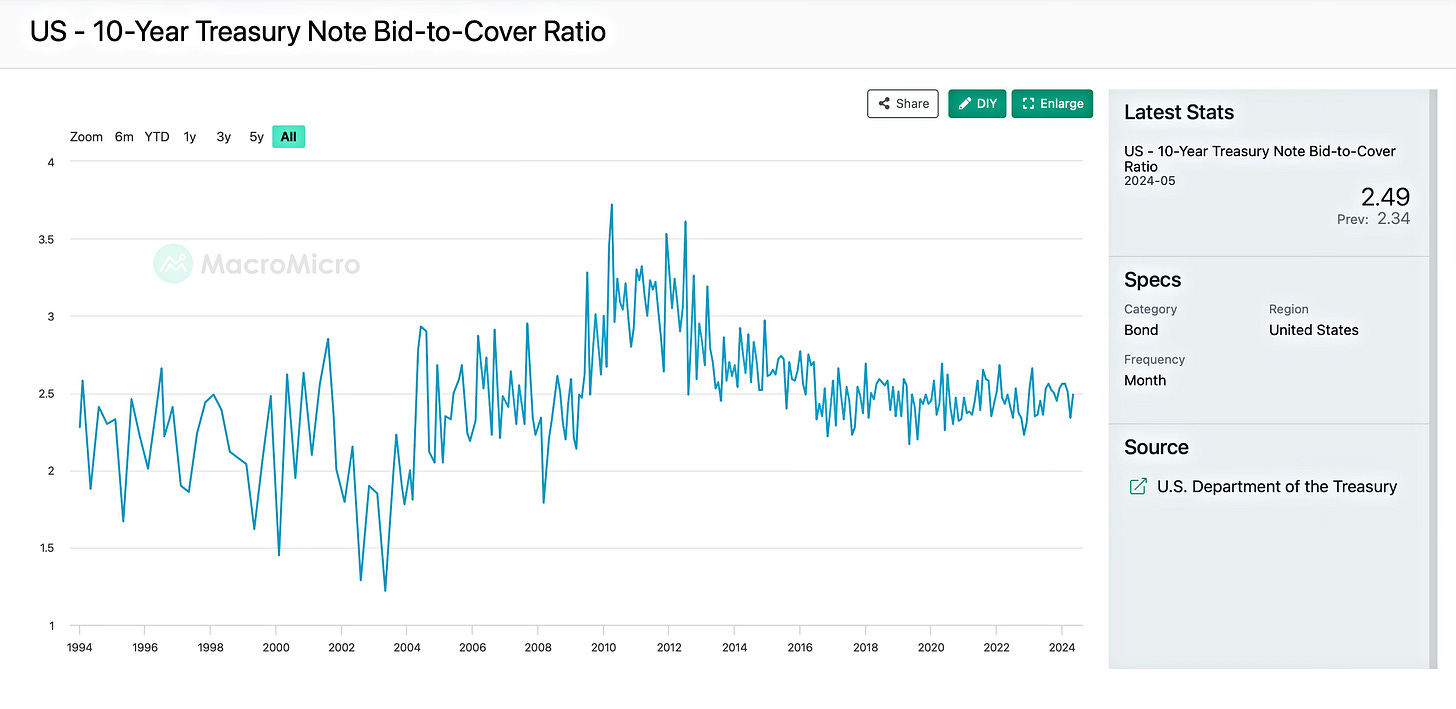

Long Term Bid to Cover Ratio for a Ten Year Note

The auction results above are for a one year note, but the same bid to cover ratio can be applied to study the ten year note as well. For the ten year note, we can compare the current ratio (based on recent auctions) to its past by using a time series plot (below)

When contextualized with other macroeconomic indicators, this tells us a story too. Even with mounting US debt, the investor appetite for a ten year note has remained at a steady 2.5x

The long term average demand for a ten year note is 2.5 times the offering - for the last ten years

So, the next time when the bitcoin broseph waxes poetry about how the world doesn’t trust Uncle Sam anymore and all currency should be decentralized, you can ask him about the bid to cover ratio for treasury bonds

Who am I kidding ? - it’s easier to reason with a drunk honey badger than reason with him

Source : Treasury Direct and MicroMacro

Thanks this is didactic in the best sense. :)

Do you have any insights into practical difficulties of issuing shorter tenor TIPS of "Trillionths" (security that pays x% of the NGDP at a future date)?