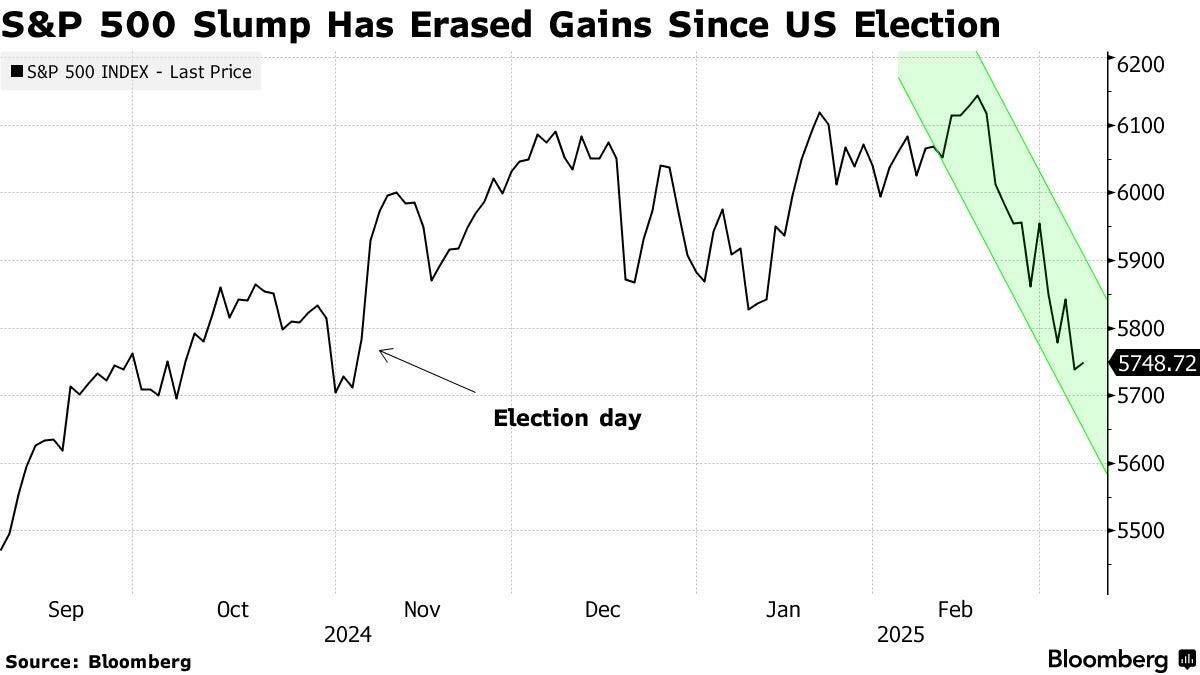

So, we are back to where we started on election night - let us just go up and down this god-forsaken water slide, shall we ?

That’ll help !

This is worse than drunk-dialing your ex and telling her you love her - like ten years after you broke up

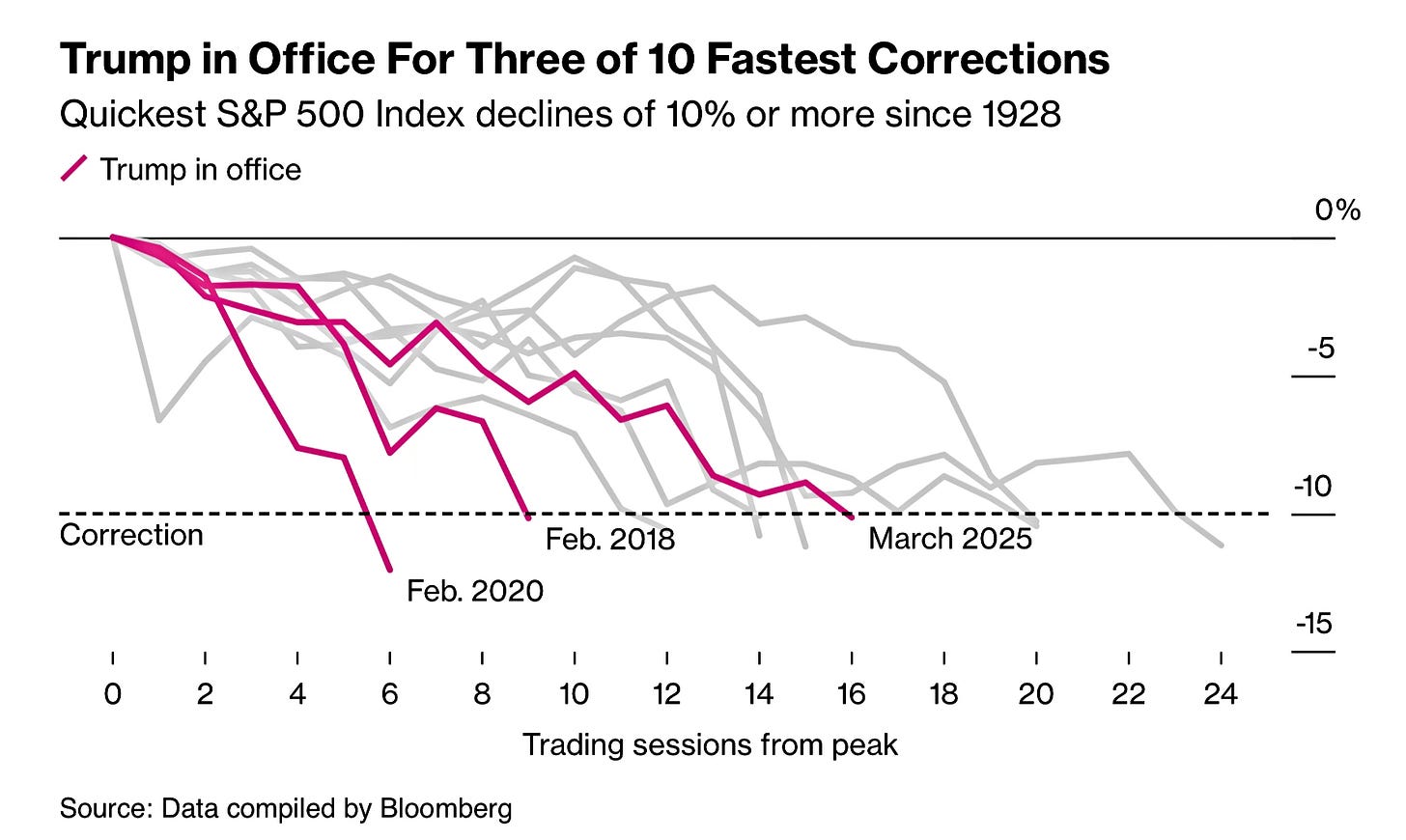

Correction in the stock market essentially means, the index fell 10% from its most recent peak. To understand the speed with which this can happen, all it took were 16 trading sessions for the US stocks to get into correction territory from their most recent peak on 2/19

Its the seventh fastest drop in our history

Three out of ten is not the batting average you’d want for this metric

When this happens, if we don’t dip further and enter a recession, on an average it takes about eight months to get back up to that peak again

‘tis way too easy to go down that water slide than get back up

On an average, non-recession dips in the stock market are around 14%, but if we do enter into recession territory, then the dips are, on average, around 36%

We ain’t dipped into recession territory yet … and we would want to keep it that way

Nothin’ wrecks my day more than seeing all red on the WSJ or Bloomberg homepage

Last week we talked about VIX - and how it captures investor sentiment in the stock market - for the next 30 days

A natural extension of that is to talk about PCR - Put to Call Ratio

We buy Puts to cover our downside risk, if a stock is trading at 100, if you buy a Put for a strike price of 100, for 30 days into the future, then you can sell the stock at 100, even if the market price of the stock is at 80, up until a month from now

You pay for buying the Puts, but it is essentially insurance, your max loss is just what you paid to buy the Puts

You do this to cover your downside risk, this week the market dropped more and it is in free-fall, so covering your downside risk is of paramount importance

No cowboy nonsense in this house, we take finance seriously … so no cowboy nonsense

On the other hand,

We buy Calls to not miss out on the upside

If a stock is trading at 100, you can buy a Call for a strike price of 120, for 30 days into the future. Then in about a month, even if the stock pops to 150, you can still buy it at 120, because you hold the options to do that. Sell it in the open market and make a profit

You pay for buying the Calls, but if the stock pops, your upside can be limitless

You do that - to not miss out on the upside

Yeah ?

Imagine if the market contains 1,000 people, 600 of them bought Puts, and 400 of them bought Calls - for the same stock, for 30 days from now

The total volume of buyers, of Puts to Calls is 600/400 = 1.5. We call this Put to Call Ratio, or PCR

So, 1.5x people are expecting the market to go down in about a month, and they want to cover their downside risk

A high (greater than one) Put to Call Ratio indicates bearish sentiment

This isn’t just forecast - it is people actually spending money to protect their assets. PCR is a brilliant and intuitive way to understand how investors are thinking about the market in the near future

This one below is intuitive, right ? We talk about the next 30 days, it is March 2025, so, if you want to look at the next one month, we’d look at April 2025, and then beyond

This is for the entire S&P 500 (here)

So, PCR for 04/25 spikes to 1.1 and then it goes back down to 0.15. As in, investors think the S&P 500 is going to drop in the short run, but increase in the medium to long run

As market conditions change - this plot will change as investors evolve in their sentiment

For 04/25, 1.1x investors bought puts when compared to calls … and that’s a bearish sentiment. Investors are expecting S&P 500 to drop and they are protecting their downside risk for the next month

They are probably nervous about the trade war - as they should be

So, this is how you would read the market, and once you know how to read the market, you can cut through all the noise and go your merry way - straight to the signal

Similar to VIX, PCR is another way to understand market and investor sentiment

The key is to cut out as many opinions in the middle, as possible - and go straight to the source of truth

Math … just straight up math, no opinions

Reference : fintel.io

We love Billions and Industry on Wall Street, these are terrific reads, Vulture (here and here) and New York Times